Introduction

Medical device manufacturers must increase their efforts towards the hospital economic customers in order to successfully launch products and maintain profitability. Increased cost pressure is leading towards increased global purchase standardization and new procurement initiatives. 1,2

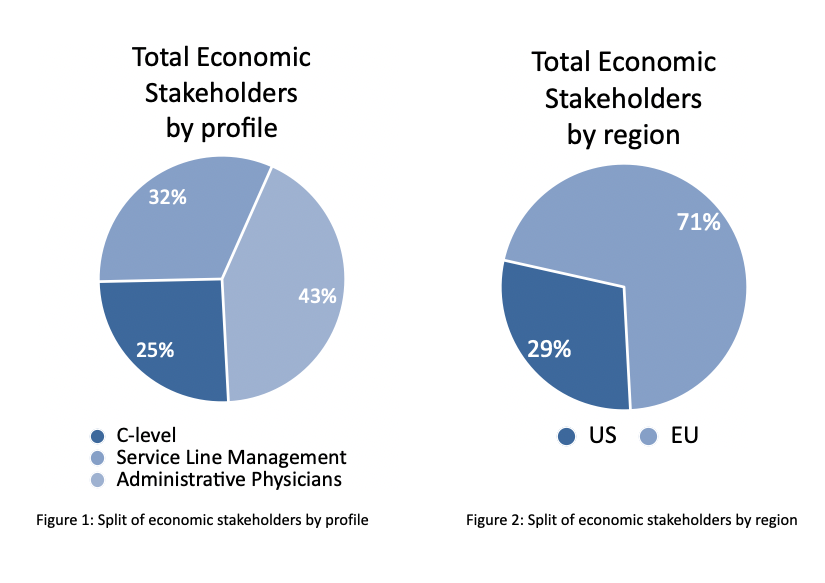

In order to gain insight in the way the economic stakeholders are looking at their goals and how they are evaluating partnerships with medical device manufacturers, SUAZIO conducted analysis of interesting key insights from hospital C-level Administrators, Service Line Management and Administrative Physicians. For this we did a meta-analysis of historic performed research in EU and US. In total, we included N=1,616 economic stakeholders in our analysis. (figure 1 & 2)

Value drivers

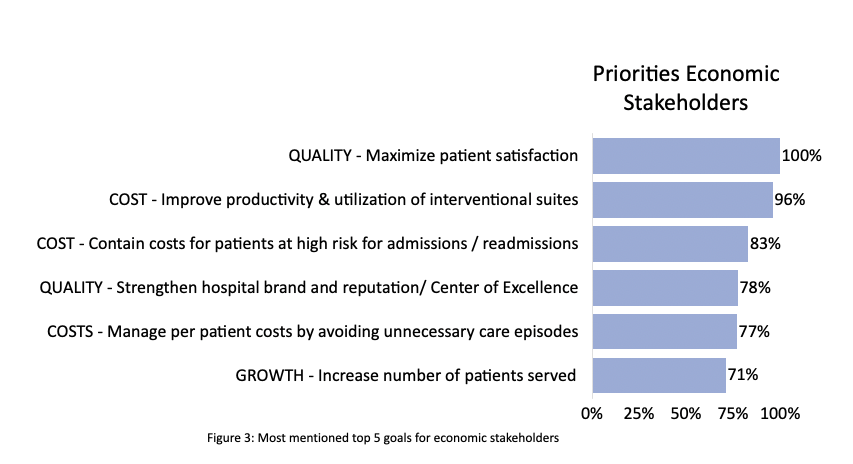

Our meta analysis revealed interesting insights into the overall top five goals that economic stakeholders mention for their hospital. In general we see that most of the value drivers are related to cost containment, productivity and quality. Maximize Patient Satisfaction is mentioned most, which is clearly the ultimate goal for a hospital. However, economic goals like Improve Productivity (96%) and Contain Cost for patient at high risk (83%) are mentioned in the overall top three in most important goals for our sample. (figure 3)

Payment modalities and support

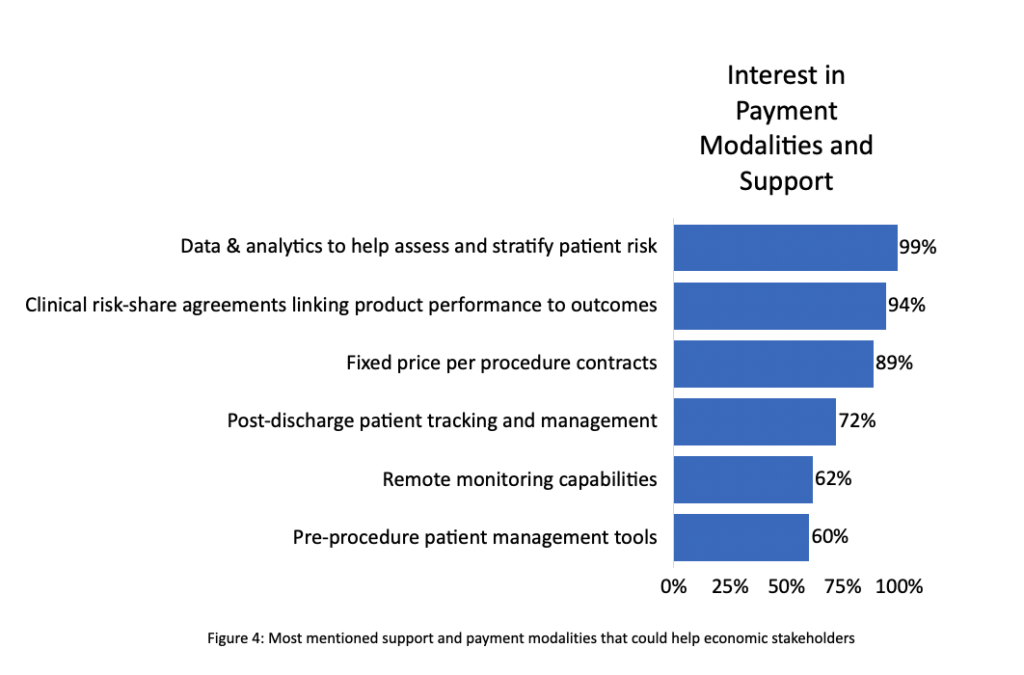

Additionally, we assessed how economic stakeholders see ways in how medical device manufacturers could help them in achieving their goals and ways of alternative payment modalities. Nearly all respondents highlighted Data & Analytics to stratify Patient Risk as a top way to help them achieving their goals. This was followed by Risk Share Agreements and Fixed Price Contracts. (figure 4)

This indicates that the economic stakeholders see ways of collaborating with medical device manufacturers to achieve their goals. Many of the key attributes relate to managing risk, productivity and cost.

Actual partnerships

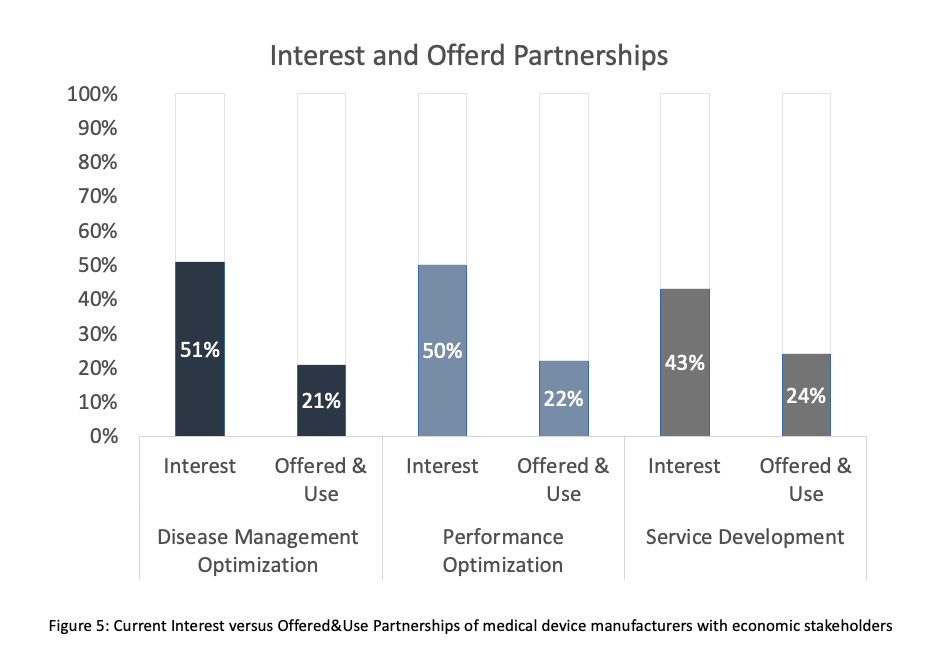

In order to help economic stakeholders reach their goals we also looked at potential partnerships that reach further than contracting or payment modalities. Here we see a difference in the Interest and the actual successful offering of a Partnership.

For Disease Management Optimization, there is an interest of 50% of economic stakeholders. However only 21% of the interested group is currently in active partnership. Similar results we see in Performance Optimization (50% Interest, 22% Use) and Service Development (43% Interest, 24% Use). (figure 5)

Conclusions

The economic stakeholders have goals related to productivity and cost containment and see multiple ways how medical device manufacturers could help in achieving these goals. However, if we look to actual partnerships, it seems there is a moderate interest and utilization of a deeper collaboration.

Hospital economic stakeholders have a higher interest in analytics and cost/risk containment tool versus a deeper collaboration with a medical device manufacturer. However, this could be the result of high productivity pressure where hospital simply don’t have the time and resources to invest in a deeper relation. If medical device manufacturers market the collaboration in a low involvement way to improve productivity and contain costs, it could be a better way of engaging with economic stakeholders.

SUAZIO consulting is an expert in medical devices and diagnostics strategic insights creation. In the next weeks we will present more data on the impact of COVID-19 on different health care markets.

If you are interested to learn more about this data, please contact Jasper van de Sande, Business Consultant at SUAZIO, j.vandesande@suazio.com, +32470927014